How does intranet knowledge base improve sales at banks?

Intranet knowledge base in a bank or other financial institution constitutes a key part of strategy implementation and building a competitive advantage. Proper acquisition, maintenance, analysis, and use of knowledge require appropriate infrastructure: organizational and technological. Properly implemented tools effectively support this process, even in such a demanding industry.

What is knowledge management in an organization?

Since knowledge has become a basic economic resource and a base for innovation, organizations keep trying to create the right framework and systems for its proper use. Effective knowledge management should consist of four elements:

-

Knowledge creation or acquisition requires obtaining information from inside and outside of the organization.

It is an important process that can become the main factor of success and building a competitive advantage. But not the only one.

-

Storing knowledge

The challenge companies have been facing for years: how to store knowledge to protect it from being taken over by the competition, have easy access to it, and enable its smooth flow within the organization at the same time. Modern technology, including modern intranets designed in the SaaS model, cope with this challenge better and better.

-

Disseminating knowledge

Transforming tacit knowledge into explicit knowledge, and effective knowledge exchange between employees, departments, or organizational units. For this, you can use available official tools (e.g., training, internal communication, documents, mentoring) and unofficial tools (e.g., social learning).

-

Applying knowledge in practice to achieve strategic goals

Solve problems, make the right decisions, or increase efficiency.

Knowledge management in the financial industry

A huge amount of information on changing legal regulations, market situation, interest rate fluctuations, risk control, and, of course, multiple insurance or loans offers make knowledge management a strategic objective of every financial institution. That applies in particular to the sales and customer service departments. What are the benefits of effective knowledge management strategy implementation?

- legal compliance security and sensitive data protection,

- maintaining public trust,

- decision-making by the management board and leaders become more conscious – more effective risk management or precise adjustment of the product offer to the market needs,

- customer service improvement – for example, reduction of the waiting time for service in stationary branches, efficient information provision, and decision making (shaping Customer Experience),

- the consistency of the offer and the quality of customer service (e.g., thanks to quick data update) are maintained at the same level, which speeds up and facilitates the sales process,

- streamlining HR processes – including onboarding, talent management, or Learning & Development processes (shaping Employee Experience).

- strengthening employees’ engagement – easy access to knowledge makes it easier to perform their duties.

Knowledge management in the financial industry is a complex process that has recently been successfully supported by more technologically advanced tools, such as the intranet. The database, which is part of a well-designed intranet, facilitates the work of all departments, including primarily sales and customer service, which are on the front line of building customer engagement.

How an intranet knowledge base helps sales and customer service in the financial industry

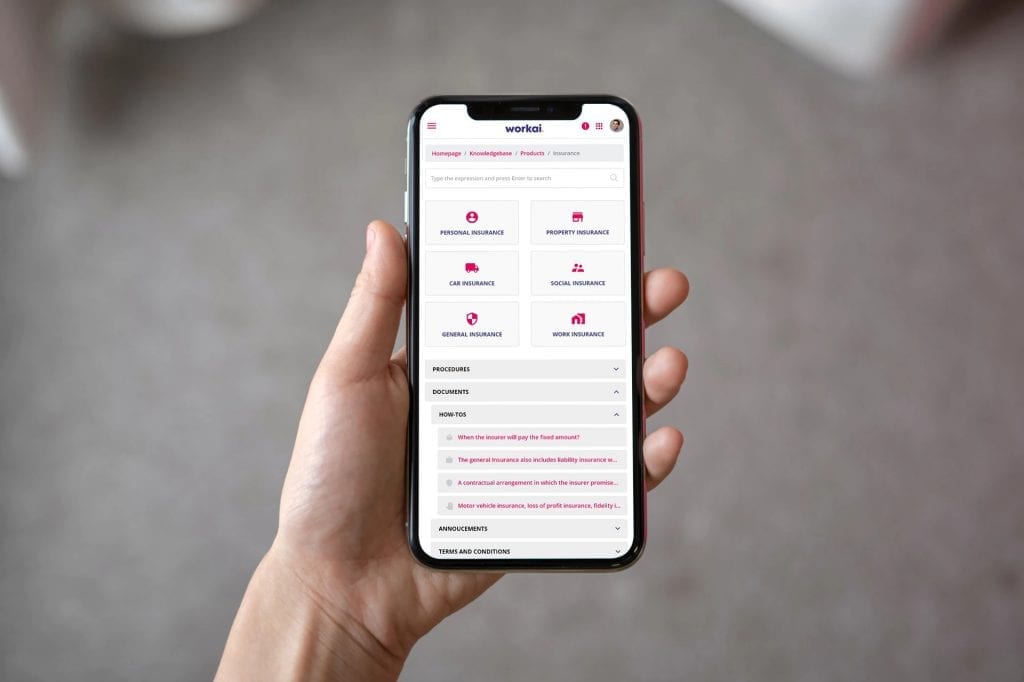

A properly designed intranet for a bank is a tool for two-way communication, where knowledge flows in every direction but with maximum security. How do the most technologically advanced databases created for the financial sector work, and what do they base their effectiveness on? It is provided by several essential features, such as:

- Quick and easy data update – one of the most important functions of the intranet for the financial industry is an easy publication of information by authorized users. All resolutions, regulations, offers, product files, or presentations are easily accessible and can be effortlessly updated and archived. Protecting sensitive data also requires proper authorization management: the access can be limited to specific departments (e.g., sales and marketing), job groups, or selected individuals.

- Easy access to data – multi-channel information distribution, user-friendly interface, mobile intranet version, or, finally, a capacious and well-planned database ensure that bank employees have constant access to current information they need at any given moment.

- Personalization is an important element of shaping a positive employee experience, but most of all a useful measure that allows you to adjust the scope of information to individual needs. That enables sales and customer service departments to track all information arising from the areas they cooperate with daily, e.g., marketing or finance.

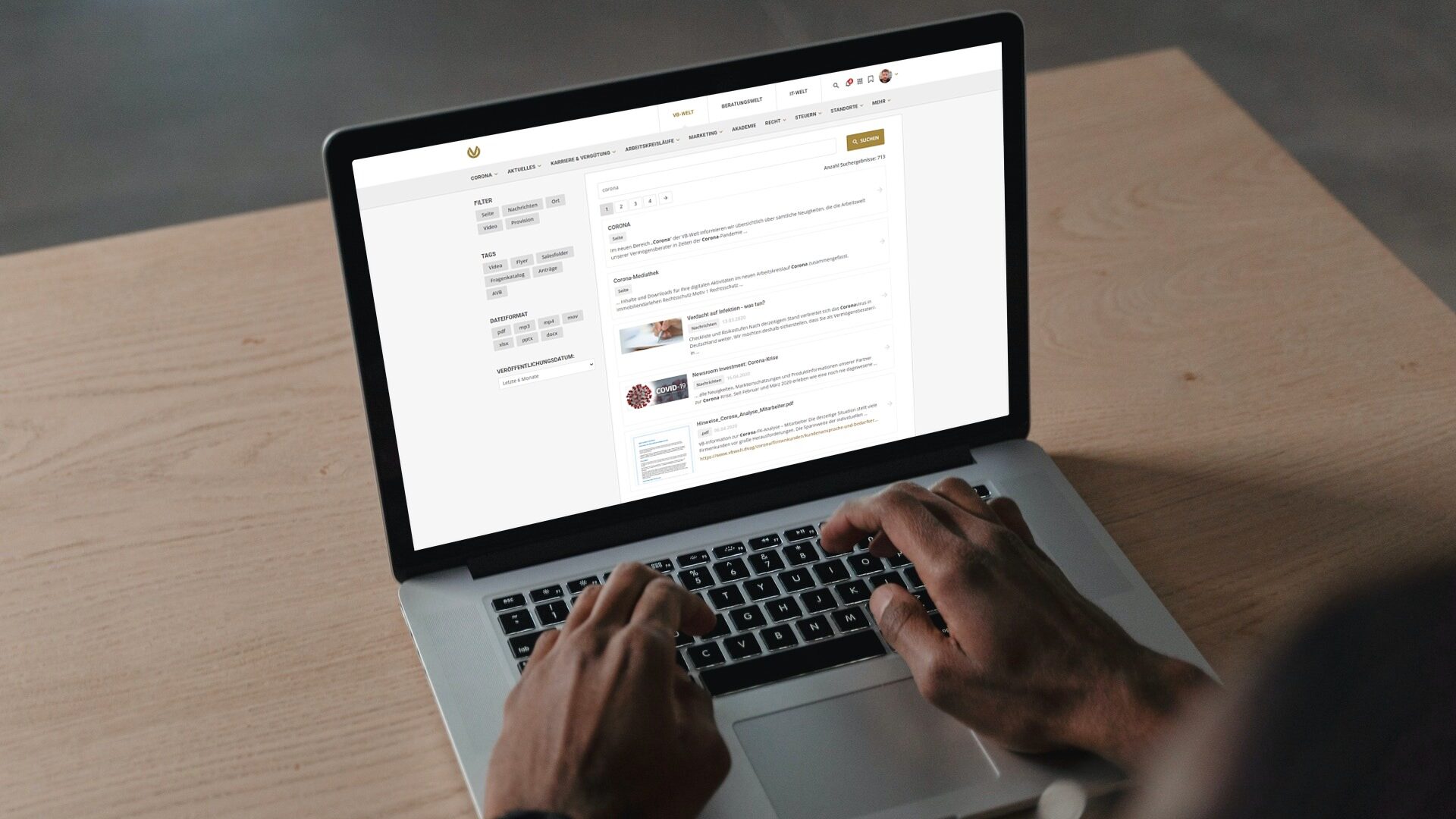

- An intelligent knowledge search engine based on AI significantly shortens the time of finding current offers or regulations that the customer or seller advises on. It is a technologically advanced tool based on algorithms and keywords, significantly increasing the accuracy of the search.

- Tagging and hashtags – another function that makes the searching process quick and increases its relevance to the needs of employees. Tagging the departments that should get the message gives greater certainty that the information will reach the right people. This tool can, for example, support the communication of the marketing department with advisers and sellers from local bank units.

- Push Notifications – This is a great example that employee experience can be shaped like customer experience. Short notifications displayed when using the browser allow you to reach the right people with all the updates at once.

- Analytics and feedback – research of the opinion of employees who are on the front line and have direct contact with the client should not take place once a year, during the engagement analysis survey. In a dynamic work environment and a difficult market situation, the needs of employees change as quickly as the needs of customers. Modern knowledge management tools allow you to measure engagement, diagnose immediately the problems, get feedback, or examine quickly training needs for a new product or service.

All these functionalities support mutual communication in strategic departments of financial institutions, engaging employees with multimedia content or allowing them to express their opinion quickly. However, the most important is that modern intranets for banks enable you to manage knowledge safely and effectively, even in such a demanding industry.