10 Key Features of Intranet for Banks and Financial Services

Although the outbreak of the Covid epidemic accelerated the process of digitization in financial services, this change was inevitable anyway. The dynamically developing financial sector has been needing technological solutions supporting knowledge management and internal communication for a long time. Therefore, financial organizations more and more often decide to implement intranet for banks, the software dedicated for this industry.

This option translates into a smoother flow of information, but also more efficient functioning of all the structures, as well as better quality of customer service.

However, what are the key features that a well-designed intranet for a bank must have? Read below:

1. Intuitive information architecture

Each of us once started a new job. The process of employee induction is essential during the first days. The amount of information to be assimilated is enormous, which is why proper segregation is so significant. In the case of new bank employees, easy access to information and processes descriptions is crucial. There is no room for mistakes here, especially when they work directly with clients. Customers, who use many automated applications every day, are used to immediate services and minimal waiting time. To provide them with the highest quality of service, the execution of financial services must be efficient, fast, and free of hesitation. How can you make it this way?

Implement a digital employee experience platform dedicated to the financial industry and focus on well-developed information architecture

Logically grouped content makes it much easier to search the information but also to navigate between the pages. The information architecture of an intranet for banks must be highly intuitive to fulfill its role perfectly, even for those who start working with the software. It should include product descriptions, processes, marketing materials – all the information necessary for your employee to perform daily duties.

Do not overcrowd the navigation of your intranet

The long drop-down menus tend to irritate the people searching for information. It is very easy to overlook the appropriate content using this kind of menu. The effective intranet for financial organizations should have a mega menu with a waffle menu icon. The top navigation should contain about 3-5 options and have logically grouped content.

Organize the knowledge base for your bank

It is not enough to create a place to store information. The knowledge base should constitute a coherent whole, be organized logically, and be easy to navigate. Provide employees with the ability to quickly reach the proper sources by organizing them into knowledge areas, tagging them, and logically dividing the files into thematic groups. FAQ lists are always helpful. Try to avoid repetitive questions and let your employees quickly get an answer to a specific query.

Make the content creation easy and intuitive

The creation of the knowledge base should be easy, intuitive, and problem-free. There is no time in the financial industry to waste on complicated content creation and management. Take care of the UX, which is of great importance.

2. Advanced knowledge base

Internal communication tools in financial organizations should have an extensive, easy-to-use, and flexible knowledge base. It should be the most up-to-date source of knowledge and provide the opportunity to reach the requested information as quickly as possible. Solutions that use artificial intelligence are helpful in this. However, an extensive search engine is not enough. To fulfill its role, the knowledge base should be perfectly organized. It should also make it possible to monitor the security of files: register changes, new and old versions of the documents. You should also have the possibility to view archived documents and preview who uploaded or changed them. What should a good knowledge base contain?

- easy and intuitive CMS to build structured bases of any kind,

- intuitive UI/UX,

- options of automatic versioning, archiving, or scheduling the documents,

- possibility to give feedback and ask questions that support collaboration,

- control system on assets rights

- training and courses area

- advanced content classification through tagging and hashtags.

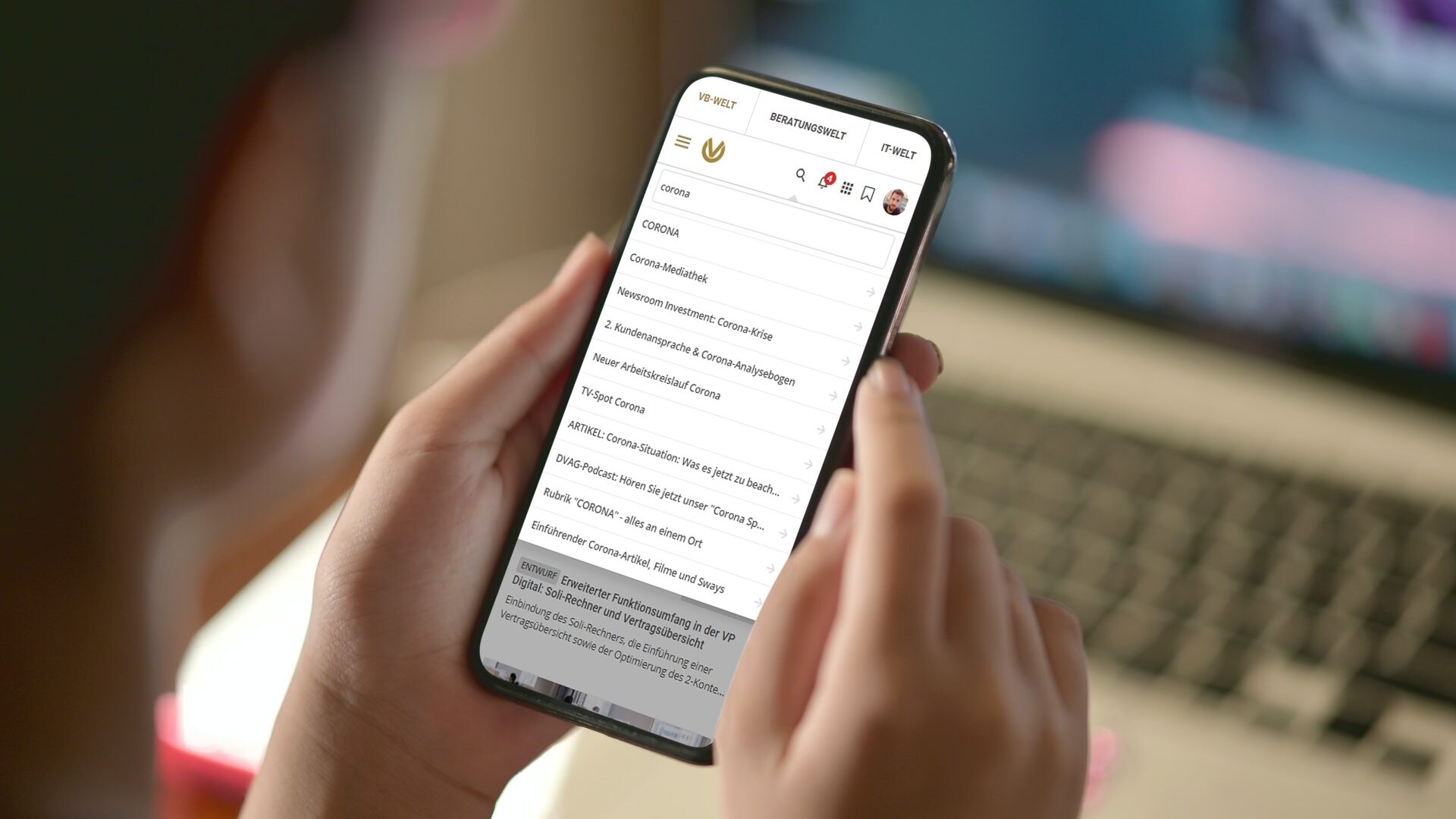

3. Intelligent search engine

In the case of front desk workers and call-center consultants, time is of the essence. Especially when the customers ask them questions, they don’t know how to answer at once. Unfortunately, we still don’t live in times when a search engine can read our minds and automatically provide the answers, but the AI-assisted search engine plays its role quite well. How can AI technologies help the employees of the financial organization?

- An intranet for banks with an AI-based search engine may prove to be significant support for sales departments, where the speed and accuracy of responding to customers are valuable. By displaying information selected only for a specific segment, an employee can avoid digging through information completely unrelated to his position.

- With an intelligent search engine, it’s easy to find the right data, documents, regulations, policies, or offers. You can always browse previous versions, rollback to the selected one and leave your comments.

- An intelligent search engine that can find the relevant information even in the content of the documents reduces the time of searching and quickly provides relevant results. Especially, when you can sort the results by the author, signature, the date of entry in the force, etc.

- Such a search engine can suggest to you the content that you might be looking for, promote and personalize the search results. It also allows the use of keywords and more advanced algorithms like:

✅ semantic search that understands the user’s intentions and evaluates the most relevant results, considering the context,

✅ a suggester that provides you with a list of suggestions while you are typing

✅ faceted navigation – filters to better find the relevant information

4. Multimedia resources

Time to appreciate the potential of multimedia! By using them during courses, you will significantly make the message more attractive for your employees. In this form, the intranet content will undoubtedly become more engaging and easier to remember. That is extremely important in an environment where new products and promotions are introduced very often.

By creating multimedia courses on your intranet, you gain better control over your employees’ knowledge development. It is easier to control not only the level of their knowledge but also their learning progress. Courses may require the employees to confirm that they have undergone them. You can also quickly test their knowledge.

5. Multichannel information distribution

Opt for an omnichannel employee experience platform to ensure an adequate flow of information and ensure that the messages reach the right audience in your financial organization. Thus, you increase the chance of getting the latest information by the employees. Whether the employee received the newsletter with the latest promotions, or the customer came to ask for the offer’s details, it will always be easy to get the latest up-to-date information about the products.

Through which intranet’s channels can the information arrive?

- Personalized home page – do not overload the home page! Put here the general topics, main news, and personalized updates,

- Pop-ups – appears on or above the content, easily catching the attention,

- Newsletter – provides personalized information about changes and events as well as plans for the near future,

- Rotators – you can place several messages in one place, all you need to do is rotate to have access to them,

- Message bar – display alerts, workflow tasks, important messages.

- Microsoft Teams – integration with MS Teams allows you to share files and pages with MS Teams. In two clicks you can share the content with the whole team or a channel.

6. FAQ Lists

If you notice that employees consult procedures with each other all the time, and their superiors are bombarded with the same questions repeatedly, you need to take appropriate action. The intranet for financial services with a knowledge base is the basis; what next?

Create FAQ lists. Your employees will be able to quickly find the answers using the database of questions and answers. If there is no answer, the employee can ask a question to the expert. The expert’s replies will always be stored in the knowledge base so they cannot be lost. No more duplications, no more chaos!

A financial sector’s employee should always be well-versed in the offer of his bank, whether as a salesperson or as a call-center consultant. When working with a client, there must be no moments of hesitation, a long time searching for information, or ignorance of the regulations. Such behavior leads to a decline in customer trust, and the employee puts itself in a bad light. By creating lists of questions and answers, you minimize the risk of overlooking important issues by the employee. Additionally, you can easily explain non-obvious entries, increasing the employee’s awareness. FAQ lists eliminate the need to ask the most frequent questions, which saves time. What’s more, the employees gain self-confidence, and their employee experience immediately improves.

Thanks to the saved expert’s answers, the employee will find solutions to his problems easier. Easy access to expert knowledge has an impact on the level of customer service. A higher level of expertise and information translates into greater trust.

7. Personalized newsletters and marketing information

In a world of constant changes, updating, introducing new regulations, laws, and products, the effective flow of information for financial services is worth its weight in gold. Newsletters play an essential role in informing employees about changes. However, just sending a newsletter to all employees is not enough. What should you remember?

- The information contained in the sent message should be personalized, adapted to the position and role of the employees. It is not worth burdening them with information that is unnecessary in their daily work, they may omit the important content!

- From newsletters and product news, employees should easily navigate to related product pages, containing up-to-date information (such as price lists, regulations), as well as announcements of planned changes to be introduced in the future and historical documents.

8. A usable mobile workplace in your bank is a must

A mobile intranet for banks in today’s digitized times is not only a necessity but also a huge benefit. Especially for financial services employees.

- More and more employees tend to use their mobiles at work, on the go or during travels. Therefore, responsive web design is so important. The intranet must be adjusted perfectly to mobile devices requirements to fulfill its role. The content should be prioritized and arranged vertically.

- Sales consultants very often visit bank clients at their company’s headquarters or homes. An employee who has a business phone or a tablet with constant access to the company’s intranet, can connect with the knowledge base and see the latest updates at any time. He doesn’t need to always have a computer with him. Sellers can present the bank offer and multimedia materials directly from the mobile device. That will make the presentation more attractive and may influence the customer’s decision.

- With a mobile intranet, the employees of every department can have quick access to the newsletters with marketing information, podcasts, educational multimedia materials. Access to multimedia is useful on the go or during business trips.

9. Interactivity

Nothing is more conducive to employee engagement than interacting with the employees. Why not use an intranet for this? That is the best tool because every employee has access to it. Due to its specific nature, the financial industry requires the full commitment of all the employees. Using analytical tools, you can strengthen the people’s engagement but also control its level, check weak and strong points.

Multichannel feedback will designate areas for improvement and help you to decide on future actions. They could have a positive impact on people’s productivity and improve internal communication even more. Try to collect:

- General feedback regarding all the content you publish on your bank’s intranet – let your employees report their general needs,

- Content feedback and content evaluation – let employees comment on the content you publish and exchange opinions about it in the comments section. You can also allow them to rate the content with stars. The most popular and highly rated content can be placed on a special list and in the newsletter, thanks to which no one will miss the materials that are worth paying attention to.

- Feedback to search results – always make sure that the employees have found exactly what they were looking for. Thanks to a short post-search query, you will be able to control it.

- Feedback of outdated content and bugs – thanks to employee reporting of outdated content, you can quickly take action to update the knowledge base and get rid of bugs.

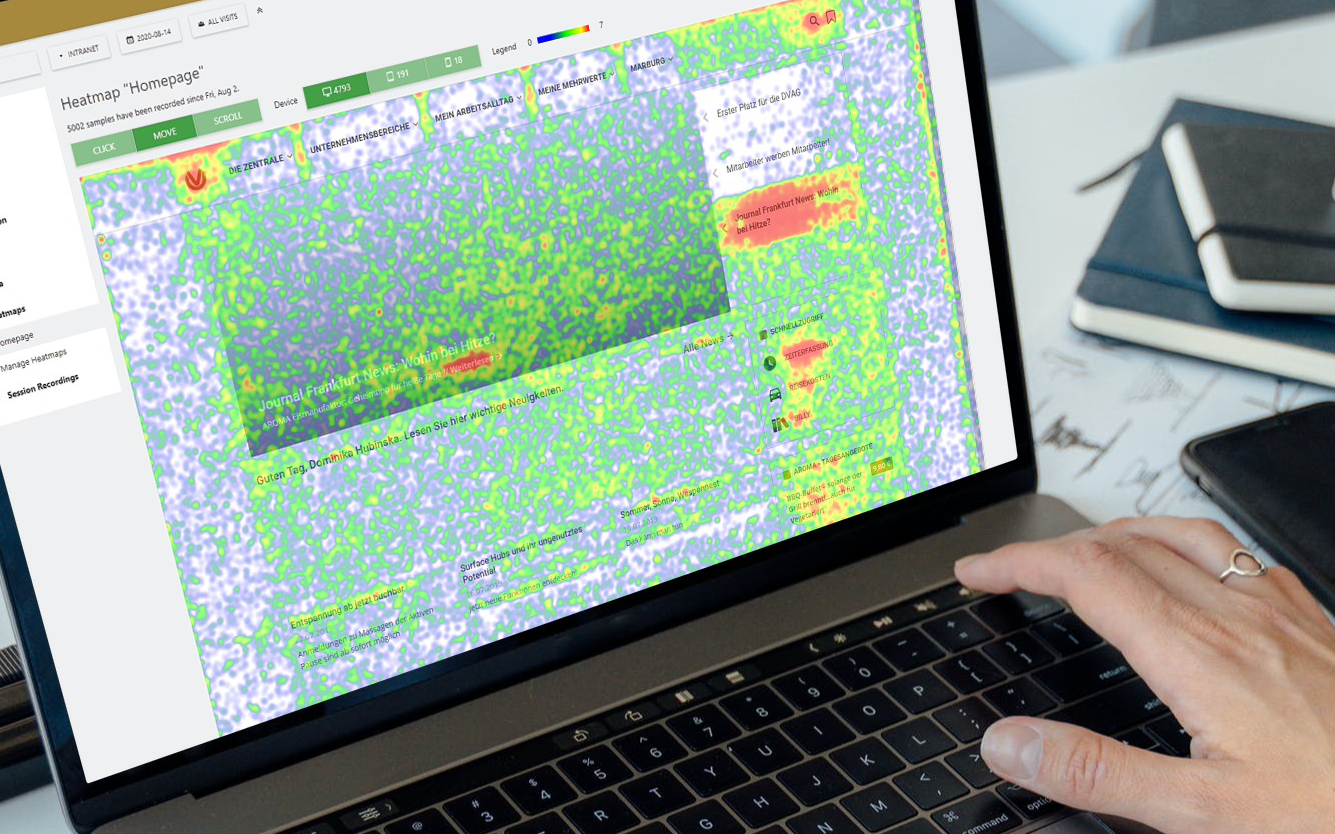

10. Analytical tools

Make sure that the correct information gets to your employees. Measuring the effectiveness of internal communication channels and the platform analysis can show you which channels are the most effective in your bank to focus more on them in the future.

- Analyze the search terms – knowing what the employees are looking for helps you in completing the knowledge base and expand the FAQ lists,

- Track the users’ intranet journey – how long they stay logged in, which links they click, articles on which topics they read most often, what files they download,

- Analyze the heatmaps that identify the hot and cold areas on the intranet so you can see what to do to optimize the content.

BONUS: Security management

While working in the financial industry or a bank, you handle money and your clients’ data. All this information should be kept strictly confidential. The possibility of their leakage or theft is a serious threat that you must avoid at all costs, also on your intranet.

With the right multi-factor security features, you can be assured of total data protection.

An intranet for banks should also enable the administration and management of licenses. Thanks to these features, the administrator always knows who used the data at what time and can easily remove permissions from people who no longer need access to specific files.

Multi-factor authentication allows you to avoid third-party hacking into the information contained on the intranet.

How does workai support internal communication in the financial industry?

We successfully implement our platforms in financial organizations and banks, ensuring the smooth and safe flow of information even in the conditions of employees’ dispersion. Our solutions support internal communication from the beginning through a quick implementation process and easy content building.

Workai covers four main areas – internal communication, employee engagement, knowledge management, and workflows. You don’t need any technical skills and long training to start using our platform. All modules are integrated but can also work independently to improve chosen processes. Workai’s knowledge base allows you to:

- search content published on the intranet

- search within file content and external sources

- use smart hints and auto-completed results

- ask for feedback for search results

- see promoted search results

- custom keywords for each page

- analyze search results and keywords without results

Our employee experience platform allows you to quickly inform your bank’s employees about the latest offers, products, changes in regulations through multiple channels. It enables you to build and organize a knowledge base. It uses artificial intelligence technology that supports the search for materials. It offers you the analytics of both user interactions and search relevance. In 2021, workai won the Norman Nielsen Group award for one of the best intranet designs for the project made with DVAG, Germany’s largest financial advisory organization.